Who is affected by the change from "water fee" to "water tax"

Who is affected by the change from "water fee" to "water tax" -Starting from December 1st, the national water

resource tax will undergo a large-scale reform.

In October this year, the Ministry of Finance, the State Administration of Taxation, and the Ministry of Water

Resources issued the "Implementation Measures for the Pilot Reform of Water Resources Tax" (hereinafter referred

to as the "Implementation Measures"), which clarified that from December 1st, 31 provinces across the country

will fully implement the pilot reform of water resources fees to taxes.

It is worth mentioning that after the comprehensive implementation of the pilot reform of water resource fees to

taxes, all water resource tax revenue will belong to local governments, and local independent financial resources

will be appropriately increased.

Professor Bai Yanfeng from the School of Finance and Taxation at the Central University of Finance and Economics

analyzed that from the previous pilot reform situation, the practice of changing water resource fees to taxes often

adopts the "tax burden shifting" method. For general enterprises and residents, the actual burden will not change

significantly. Water efficient water-saving enterprises will benefit, while enterprises with high water resource

consumption and extensive production and operation will increase their overall burden. This is the original

intention and direction of the reform.

What impact will the comprehensive implementation of the pilot program to change water resource fees to taxes

have on enterprises?

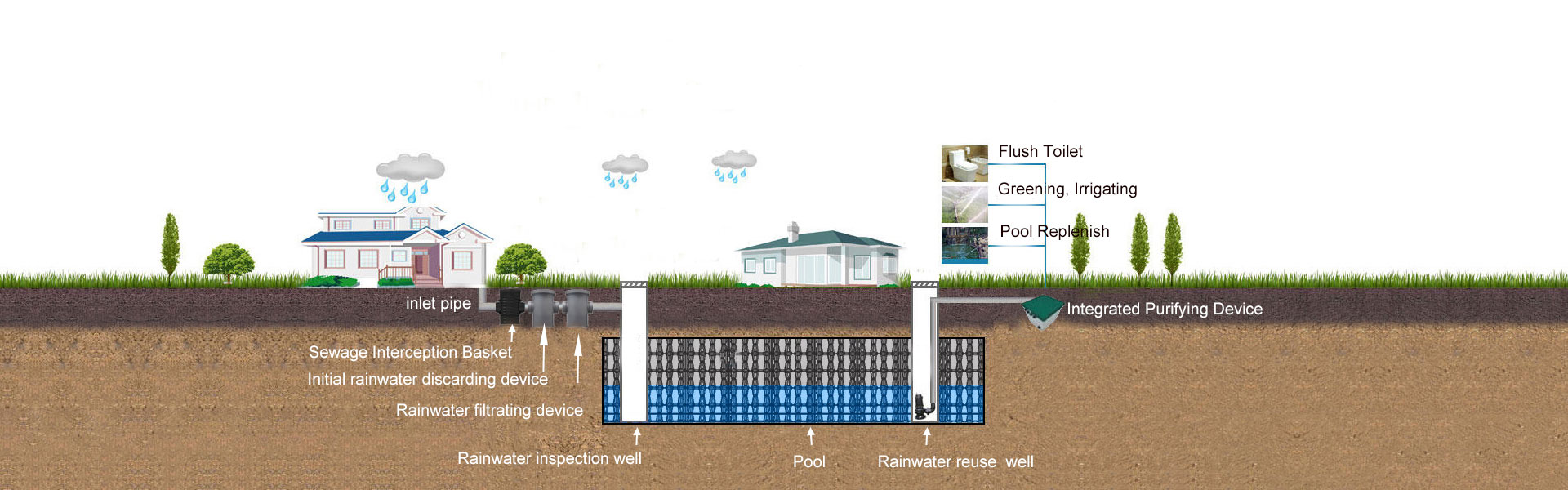

Shi Zhengwen, Director of the Finance and Taxation Law Research Center at China University of Political Science

and Law, stated that the water resource tax adopts a differential tax rate standard and implements policies such as

tax exemption for the use of unconventional water sources such as sewage treatment and reuse water, recycled

water, and rainwater, in order to effectively encourage enterprises to use water for environmental protection.

At the same time, the tax burden on high water consuming industries for water extraction, over planned water

extraction, and over extraction of groundwater will significantly increase. Therefore, water-saving enterprises with

high water efficiency will benefit, while enterprises with high water resource consumption and extensive

production and operation will increase their overall burden.

The ecological significance of the water resource tax reform far exceeds its tax significance. This "tax based water

management" reform not only changes the water use structure and efficiency, but more importantly, deeply

instills the concept of green development and fundamentally improves the water ecological environment.